Why boosting IRS funding would be good for your family

If you have any questions for the IRS or you still haven’t seen your tax refund — perhaps even by 2020 — get in line.

The Internal Revenue Service has seen its workforce decrease by 17% since 2020, while its workload has reportedly increased by 19%. The well-known agency has lagged behind.

Deputy Treasury Department Secretary Wally Ademo recently told NPR about some of the agency’s ongoing struggles. “Last year, the IRS received 230 million phone calls and had only 15,000 people answering those calls, which meant each person had to answer 16,000 calls.”

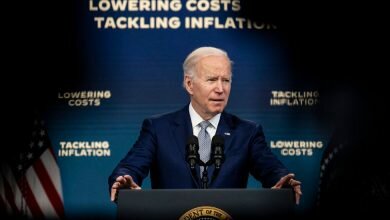

The Washington Examiner said the IRS is pushing for $80 billion in funding to double its workforce and improve its efforts to catch tax fraud. The House has approved the motion, but the Senate is hesitating.

If you’re tempted to address the challenges that the IRS faces as insignificant, it may help to consider the ways in which the tax-collecting, refund-disbursing agency can help families and communities flourish. – Helps in flowering.

“The inaction matters not only because ‘taxes are the lifeblood of the government,’ as a Supreme Court justice famously wrote in 1935, but also because the IRS provides benefits in the form of tax credits that specifically are critical for Americans who are struggling financially. Historical inflation and the ongoing pandemic,” wrote Orion Donovan-Smith, spokesperson for Review. The child received monthly payments of up to $300, they may not receive the other half of that child tax credit until their tax return is processed.”

Other reasons families should keep in mind that the IRS works as intended:

- According to The Washington Post, the United States cannot run a functioning government without the IRS, which considers the taxes collected to finance government operations important. “Without tax collection by the IRS and tax code in force, the US federal government will very quickly fail completely,” the article said.

No taxpayer dollars means no federal jobs, no community block grant pass-through money, reduced public health spending, less Alzheimer’s and cancer research, and no camping and sports in national parks, millions of other taxpayer-funded cherished things that are largely to assume true without proof.

- Research from the University of Maryland and New York University, published in The Washington Post, suggests that you can appeal to a variety of partisan interests to gain support for funding the IRS. For Democrats, the IRS may have a role to play in reducing messaging disparity. For Republicans, the message may focus on how the IRS helps reduce the federal budget deficit. “One estimate suggested that better tax enforcement could eliminate nearly three-quarters of the 2019 federal budget shortfall,” noted the Post.

- Support for Ukraine in the form of sanctions depends on a strong IRS. Most sanctions against Russia, Russian oligarchs and others are set by the Treasury Department. But it is specifically the IRS investigative branch’s “expertise in complex money laundering and tax evasion schemes” that gives the federal government the skills to enforce sanctions, according to CNN. And surveys show that it matters to many American families.

- Some of the direct assistance paid to families during the COVID-19 pandemic hit citizens’ wallets through the IRS. That agency not only processes tax refunds, but also the Child Tax Credit (including the expanded version that was paid monthly directly to households during the last half of 2021) and the Earned Income Tax Credit. Other direct aid requires a tax return to determine one’s economic eligibility, including some forms of student aid for college students.

dimensions of crisis

By the April 18, 2021 tax filing deadline, the IRS had received more than 130 million tax returns, collected 95% of the revenue it received to fund the U.S. government, and $220 billion in refunds and credits. In a Treasury report, according to Natasha Sarin, consultant for the Department of Treasury Tax Policy and Implementation.

She called the recently expired tax deadline “an inflection point in the agency’s most challenging filing season in recent history.”

He said the pandemic and IRS underfunding posed huge challenges.

The agency is pushing for $80 billion in funding over the next decade—a request funded in Biden’s “Build Back Better” plan, which passed the House and stalled in the Senate, perhaps permanently. According to the Washington Examiner, the administration said the investment would generate $700 billion in revenue over 10 years, which is not currently being paid for.

Amid IRS challenges, tax season began with the agency still dealing with a backlog of 20 million tax returns from last year, The New York Times reported, noting complaints of “outdated” technology.

“We have a tax system that takes the average American 13 hours to file. It’s a tax system that’s owed and collected, which is estimated to be $600 billion a year – roughly half of GDP on an annual basis.” 3% accrues to the wealthy 1% over 30% of these unpaid obligations. It’s a tax system where torn paper returns are literally strewn with scotch tape,” Sarin said.

The IRS says it has done Yeoman’s work so far this tax season, processing nearly 100 million of the 103 million tax returns it has received, even though its computer systems are half a century old.

Adeyemo cited NPR as one of the key reasons the IRS needs more money, to make it easier for low- and middle-income Americans, who have simpler taxes to file for free, and to speed up processing so that To enable people to get their refunds faster.