Rural area properties put themselves on the market after investor pressure

Countryside Properties puts itself up for sale after rejecting bids amid investor pressure and plunging share prices

- Inclusive Capital previously offered 220p and 295p-per-share prices

- Rural areas halt their share buyback program while talks continue

- Since the start of the year, the group’s share price has fallen by more than a third.

Countryside Properties’ boss will begin the formal sale process after rejecting two takeover bids from one of its biggest investors.

The FTSE 250 housebuilder disclosed a fortnight ago that San Francisco-based hedge fund Inclusive Capital (In-Cap), which already owns 9.2 percent of the business, had offered to acquire 220p and 295p-per-share respectively .

Both the unsolicited proposals were turned down by the Board of Rural Areas on the grounds that they ‘materially undermined’ the firm and its future growth prospects.

Turned down: Housebuilder Countryside Properties has already rejected two acquisition offers from San Francisco-based hedge fund Inclusive Capital

Yet the company said it decided to put itself up for sale because of significant pressure from some investors, who believed that if it was privately held or part of a larger business, it would be able to grow. would be better.

This included its biggest investor, Browning West, who last week reprimanded the board for taking action that caused ‘significant destruction of shareholder value’.

This confirmed that In-Cap was one of those potential suitors and the only one with whom Countryside was currently in discussions regarding a takeover offer.

While these talks are underway, the Brentwood-based group has suspended a £450 million share buyback program launched last year.

The group said: ‘If there is no such compelling proposal given the Board’s view of the significant potential for business as a standalone entity, the Board remains committed to remaining rural as an independent listed company. .’

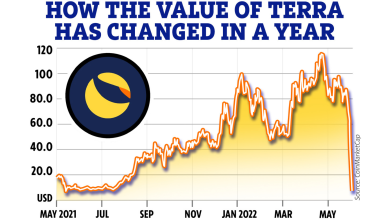

Since the start of the year, the group’s share price has fallen by more than a third, following a drop in domestic completions, profit warnings and a damning review of its site operations.

That report highlighted major problems in its North England and South Midlands divisions, with projects in the former region affected by delays and weak margins, while the latter region remained unprofitable.

Particularly heavy criticism was reserved for the homebuilder’s Westley Group subsidiary, which was bought by the firm in 2018 to expand its partnerships division across a wider geographic base.

The review said the company had “failed to realize the benefits” of its Westley acquisition, citing projects with “very low” margins or that “did not meet the high standards of the countryside”.

In-Cap’s founder and managing partner, Jeffrey Uben, has also criticized the business over the buyout, as well as its equity financing arrangement and the appointment of Ian McPherson to the chief executive role.

McPherson stepped down in January after just two years when the group issued a profit warning and its share price fell to a five-year low.

Replaced on a temporary basis by John Martin, the firm later reported a £181.5 million pre-tax loss in its half-year results, compared to a profit of £38.8 million the previous year.

Most of the damage was down to costs related to the removal of the hazardous cladding from the buildings worth over £100 million, although the firm was further impacted by the decline in the completion of the house.

Shares of Countryside Partnership were down 0.6 per cent at £2.84 in early trade on Monday, though their value has risen by more than a quarter in the past month.

advertisement

Share or comment on this article: