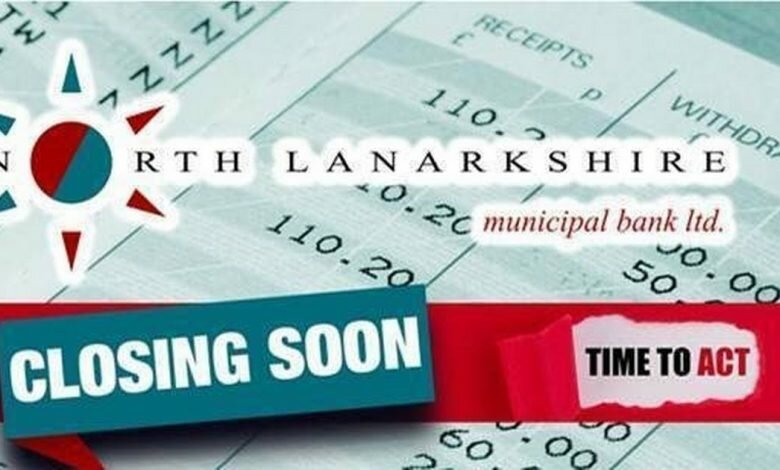

Historic North Lanarkshire Bank closing date announced

North Lanarkshire Municipal Bank will finally shut down its operations on 30 September.

Remaining customers are now being urged to take action to clear and close their accounts before closing in less than five months, by making alternative arrangements and transferring their balances and automatic payments.

Additional deposits are now being “discouraged” as part of the closing process, with no new accounts being opened since the bank’s planned closure was announced last October.

The Lanarkshire Live App is available to download now.

Get all the news from your area – as well as the latest on amenities, entertainment, sports and Lanarkshire’s recovery from the coronavirus pandemic – straight to your fingertips, 24/7.

The free download features the latest breaking news and exclusive stories, and allows you to customize your page in the sections that matter most to you.

Visit the App Store and Never Give Up in Lanarkshire – iOS – Android

Board members decided to take action in response to a banking review that highlighted the “prohibitive cost” of meeting existing requirements related to fraud and money laundering measures and customer due diligence.

The Municipal Bank of North Lanarkshire – originally established in 1924 and established in full authority when it was created in 1996 – is one of only two such savings banks in Scotland.

It had around 5000 accounts at the time the closure was announced, the staff is now helping its holders make arrangements for balance transfers, payment changes and opening new accounts elsewhere.

read more

Related Articles

Company Secretary Ellen Kemp said: “It is important that customers now give themselves time to make alternative banking arrangements – people need to contact us so we can help them move their savings and payments to other accounts .

“We are contacting all existing customers directly to remind them that they need to contact us before the bank closes, and will encourage family members to check with relatives to see if they have an account. ”

She added: “We have a wide variety of support services available and the sooner you talk to us, the sooner we can make appropriate arrangements for help.”

read more

Related Articles

The Bank has 10 branches in council buildings in North Lanarkshire – in Airdry, Belshill, Coatbridge, Cumbernauld, Kilsythe, Moody’sburn, Motherwell, Shots, Viewpark and Wishaw.

To arrange an appointment before customers attend a branch in person “to help manage demand and expedite the process” on weekdays on from 10 AM to 3 PM The middle is asked to contact its dedicated helpline.

Funds can be transferred from the bank by expeditiously making payments to an account in the customer’s name in another bank; With three days’ notice of withdrawals in excess of £1000 in cash – although customers are advised to withdraw smaller amounts by cash “for safety and security”; or by check with seven days prior notice.

read more

Related Articles

Speaking last year about the closure announcement, the bank’s chairman Bob Burroughs – then a councilor and finance coordinator for North Lanarkshire – pointed out that the municipal bank needed to comply with the current law was “very substantial investment” in costs and stability. How will it affect

He added: “We have no choice but to follow modern money-laundering, anti-fraud and customer investigation measures, [but] The costs associated with doing so are prohibitive. The Board has decided with some regret that closure is not an option.

“Large banks are able to offer services that municipal banks cannot, including card services and online banking, and we will ensure that customers have all the information they need to identify a suitable option.”

read more

Related Articles

Officials say that apart from a dedicated helpline, special assistance is available for vulnerable customers.

Further information is also available on the Bank’s website.

*Don’t miss out on the latest headlines around Lanarkshire. Sign up for our newsletters here.

And did you know that Lanarkshire Live had its own app? Download yours here for free.